FE&S' subscribing foodservice operators take a look at how their various business concerns continue to affect the way they approach foodservice equipment and supplies purchases.

Today's foodservice operator faces no shortage of business pressures. Rising food costs remain a key pressure point for all operators. And the fact that foodservice sales are forecasted to grow anywhere from 3 percent to 3.6 percent in 2014, depending on which study you read, means the industry will likely remain in a take-share mode for the foreseeable future. That means foodservice operators will continue to carefully monitor their foodservice purchasing habits.

Today's foodservice operator faces no shortage of business pressures. Rising food costs remain a key pressure point for all operators. And the fact that foodservice sales are forecasted to grow anywhere from 3 percent to 3.6 percent in 2014, depending on which study you read, means the industry will likely remain in a take-share mode for the foreseeable future. That means foodservice operators will continue to carefully monitor their foodservice purchasing habits.

Operators will continue to value those products that will help them make the most effective and efficient use of labor and allow them to maximize food yield. Operators will continue to reward those products that provide a speedy and suitable return on their investment.

What does this mean for their supply chain partners? The market for foodservice equipment and supplies will remain price-sensitive, but dealers, distributors and other members of the supply chain can set themselves apart from the competition by being easy to work with, providing plenty of information and making sure that information is easily accessible when foodservice operators go looking for it. Most importantly, relationships still matter in today's foodservice industry.

On the following pages, we take a closer look at what FE&S' subscribing operators told us about their approach in today's complex business environment and what they would like to see from their supply chain partners. While every foodservice operator and distributor is unique in their own way, we hope this data will be useful as you evaluate your relationships moving forward.

Business Concerns

Increasing food costs represent our surveyed operators' most pressing business concern, as was the case three years ago. When looking at top concerns by market segment, though, some key differences begin to emerge. For example, beyond increasing food costs, food safety represents a significant business concern for non-commercial operators. In contrast, for commercial foodservice operators, a host of labor-related issues emerged as a top business concern. While commercial operators remain concerned about increased labor costs in general, their main challenges are in the areas of finding and training qualified employees and retaining their top performers. Labor has become such a concern, in fact, that it skipped past energy costs as a serious concern among commercial foodservice operators.

It comes as no surprise that anticipated labor pressures will have an affect on a foodservice operator's bottom line, rippling out to other aspects of the business. In fact, 80 percent of the operators surveyed report they have changed their purchasing behaviors in the past year due to the business concerns outlined above. Along those lines, 41 percent of operators altered their approach to food purchases, 38 percent changed their approach to purchasing foodservice equipment and 34 percent say they altered their approach to procuring supplies.

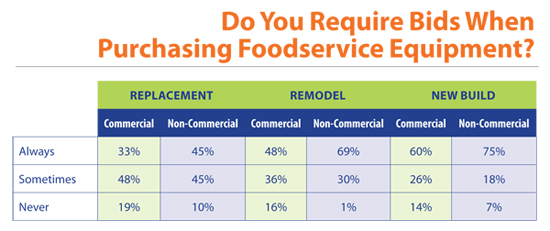

For example, 53 percent of operators planning to make a purchase will require more competitive bids when purchasing new equipment or replacing existing items. And 47 percent of operators plan to repair some of their existing items rather than purchase new equipment while 42 percent plan to delay equipment purchases. When it comes to supplies purchases, 54 percent of operators report carrying a smaller inventory and 41 percent have taken the extra step of consolidating purchases of these items with fewer vendors to improve pricing.

Breaking down changes to supplies purchasing by segment, 35 percent of commercial operators report using more private label products and buying more specially priced items. In contrast, 35 percent of non-commercial operators report steering more of their purchases through a buying group or group purchasing organization. And 32 percent of non-commercial operators report placing smaller supply orders.

When it comes to food purchases, commercial operators and their non-commercial peers have responded somewhat differently. For example, 81 percent of non-commercial operators report lowering the food inventory they carry compared to 56 percent for commercial operators. In contrast, 67 percent of commercial operators report consolidating food purchases among fewer suppliers, compared to 38 percent for non-commercial operators. Forty one percent of commercial and non-commercial operators report using rebates and coupons more often than they did in the past when making food purchases. And both operator sectors report sourcing more locally grown, seasonal ingredients, which is why they report placing smaller food orders and carrying less inventory in this area.

Purchasing Behaviors

Foodservice operators continue to invest in their businesses. In fact, 85 percent either made an equipment purchase in 2013 or plan to do so in 2014. Further, 90 percent of operators said they plan to buy new equipment rather than used items. Beyond the item's quality, condition and age, key factors when deciding to purchase a used item include the equipment type, cost/value ratio, availability, how the equipment was previously used and whether a warranty is necessary.

Foodservice operators continue to invest in their businesses. In fact, 85 percent either made an equipment purchase in 2013 or plan to do so in 2014. Further, 90 percent of operators said they plan to buy new equipment rather than used items. Beyond the item's quality, condition and age, key factors when deciding to purchase a used item include the equipment type, cost/value ratio, availability, how the equipment was previously used and whether a warranty is necessary.

Among those foodservice operators looking to make an equipment purchase, 75 percent conduct their own research before specifying which item to purchase. When making purchasing decisions, foodservice operators consider information from a variety of sources including trade shows, their peers, manufacturer websites and trade publications. While social media helps operators generate sales in their own businesses, it has limited credibility when it comes to researching foodservice equipment and supplies purchases.

Forty three percent of operators list traditional dealers as their main vendors for foodservice equipment and supplies purchases. Broadline distributors account for roughly 19 percent of all operator equipment purchases and at 13.3 percent, buying groups represent the only other segment exceeding 10 percent of

operators' equipment purchases.

Operators continue to direct their foodservice equipment purchases to dealers due to their sales reps' product knowledge and their relationships with the reps. Other factors that prompt operators to maintain a relationship with equipment dealers include pricing, the fact that the dealers tend to be a local company or have local representation, they have the ability to quickly remedy most mistakes or problems and there is a certain ease of ordering. Indeed, from all indications, before and after sale service seems to be emerging as a secondary factor that affects operators' purchasing decisions.

When it comes to supplies, though, operators slice their purchasing pie a little differently. Specifically, broadline distributors account for more than 45 percent of all supplies purchases and the dealers' slice of the pie shrinks to slightly more than 16 percent, just ahead of the 15 percent directed to buying groups.

Foodservice equipment purchasing decisions remain a group exercise, as operators on average involve three to four people in the process. That number goes up to four or more people for new build projects and with such titles as the director of operations, designers and architects, chefs, and owners or other c-level executives serving as primary decision makers. When it comes to purchases associated with a remodeling or renovation project, usually between three and four people play a role in the decision-making process, including the director of operations, chefs and the owners or other executive level members of the team. Finally, when it comes to replacement purchases, between two and three people make the decision.

Foodservice equipment purchasing decisions remain a group exercise, as operators on average involve three to four people in the process. That number goes up to four or more people for new build projects and with such titles as the director of operations, designers and architects, chefs, and owners or other c-level executives serving as primary decision makers. When it comes to purchases associated with a remodeling or renovation project, usually between three and four people play a role in the decision-making process, including the director of operations, chefs and the owners or other executive level members of the team. Finally, when it comes to replacement purchases, between two and three people make the decision.

When researching equipment purchases, only 25 percent of foodservice operators, and this applies to chains more than other segments, report that they test items before purchasing them. In fact, 53 percent of operators report they do not test equipment items before making a purchase and 22 percent say whether they test equipment depends on the item's price and several other factors. The most common equipment items operators like to test before purchasing them include combi ovens, dishwashers, fryers and slicers. Operators typically expect to try out the larger items in a test kitchen, while they expect to test the smaller items on-site at their businesses.

The purchasing process for replacement items can vary considerably depending on the operation. While 81 percent of operators say they like to research newer items when making a replacement purchase, commercial operators are more than 3 times likely than their non-commercial peers to consider used equipment a suitable solution.

Assessing Supply Chain Relations

In general, operators' relationships with their foodservice equipment and supplies vendors appear stable. Overall, only 20 percent of operators reported turning over at least one equipment and supplies vendor during the past year. One operator segment significantly more volatile than the others is the chain restaurant community, which saw 42 percent of its operators change a supplier within the last year.

In general, operators' relationships with their foodservice equipment and supplies vendors appear stable. Overall, only 20 percent of operators reported turning over at least one equipment and supplies vendor during the past year. One operator segment significantly more volatile than the others is the chain restaurant community, which saw 42 percent of its operators change a supplier within the last year.

Operators indicate their suppliers could improve service by making sure more product information is available and making it easier to find, and being more timely when responding to problems or other issues. Seventy-six percent of operators feel their equipment and supplies reps visit regularly enough on a monthly basis. Of course, how often a dealer/distributor sales rep should visit varies by operator segment. For example, commercial operators expect to see their dealer sales reps twice a month, on average. Non-commercial operators expect to see their dealer/distributor reps once or twice a month.

Given the highly competitive nature of the foodservice industry, it comes as no surprise that better pricing remains the primary reason operators switched suppliers. Other factors prompting operators to switch foodservice equipment and supplies vendors include better quality products and better customer service.