The good news is that the foodservice industry seems poised to grow. The bad news is that the foodservice industry will move forward at an excruciatingly slow pace.

With the outlook for the U.S. economy still a little choppy, it would appear as if the foodservice industry is experiencing similar periods of ups and downs, braced by the stabilizing performances of specific operator segments. The net result is an uncertain industry forecast with enough angles to pass for a high school geometry test.

Heading into 2010, expectations for the foodservice industry were not that great. "Many people within the industry believed we would bottom out and see recovery," Darren Tristano, executive vice president for Technomic, a Chicago-bar-market research firm, says.

And through the first seven months of the year, it appears that the industry is starting to see some sunnier days. The National Restaurant Association reports restaurant sales are up 2.9 percent through July, matching its modest growth projections for the year. "Those results are not historically better, but they are better than what the industry experienced in 2008 and 2009," says Hudson Riehle, senior vice president of the National Restaurant Association's, Research and Information Services Division. "And the restaurant industry has performed better than the rest of the economy."

Fast casual is one segment that continues to perform well and will be an area for growth, Tristano notes. He attributes this to several factors, most notably that, depending on a consumer's dining habits, this segment represents an opportunity to trade down or up without breaking the bank. Also helping this segment perform well is the fact that operators have been very innovative with their menus. As a result of these successes, the fast-casual segment has weathered the storm and seems poised to continue to do so.

Fast casual is one segment that continues to perform well and will be an area for growth, Tristano notes. He attributes this to several factors, most notably that, depending on a consumer's dining habits, this segment represents an opportunity to trade down or up without breaking the bank. Also helping this segment perform well is the fact that operators have been very innovative with their menus. As a result of these successes, the fast-casual segment has weathered the storm and seems poised to continue to do so.

Gauging the progress for other segments is not as easy. For example, chicken-wing concepts are doing well, but some traditional burger powerhouses are struggling because of the increased competition in that segment, Tristano says. Technomic projects that limited-service restaurants will experience 1 percent growth this year, while the full-service segment will grow up to 1.5 percent. "The market is still down over a two-year time frame and off from where we had hoped it would be," Tristano adds.

So the foodservice industry is on the rebound, but it is bouncing back at a historically slow rate. A number of factors are contributing to the slower-than-expected recovery. For example, consumer confidence continues to be low, and the lagging employment numbers only help keep it this way. "Employment is closely tied to consumer confidence," Riehle says. "When you look at the job losses as well as the people working only part-time, it is well into 2013 when the employment situation is doing well enough and generating enough jobs to handle the population growth."

So the foodservice industry is on the rebound, but it is bouncing back at a historically slow rate. A number of factors are contributing to the slower-than-expected recovery. For example, consumer confidence continues to be low, and the lagging employment numbers only help keep it this way. "Employment is closely tied to consumer confidence," Riehle says. "When you look at the job losses as well as the people working only part-time, it is well into 2013 when the employment situation is doing well enough and generating enough jobs to handle the population growth."

With consumers skittish about their own job prospects, they have continued their conservative spending habits, which translates into lots of market volatility for the foodservice industry. "Consumers have changed. They expected their homes to increase in value every year, and now it will take years and years for people's homes to get back to what they were worth in 2007," says Kim Gill Rimsza, president of TriMark Gill Marketing and the Foodservice Equipment Distributors Association. "Once they are more confident in their jobs and retirement savings, we will see them loosening up their spending."

Further hampering the industry's ability to grow is the country's general economic malaise. "The top challenge among operators remains the economy," Riehle says. "Three years ago it was recruitment and retention of labor, and undoubtedly that will become an issue at some point, as all things are cyclical."

Further hampering the industry's ability to grow is the country's general economic malaise. "The top challenge among operators remains the economy," Riehle says. "Three years ago it was recruitment and retention of labor, and undoubtedly that will become an issue at some point, as all things are cyclical."

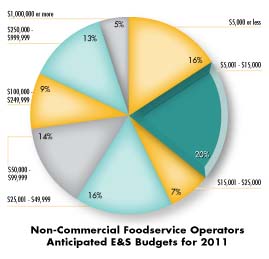

Many in the foodservice industry point to the still-tight credit markets as a factor that impedes growth. Although it is interesting to point out that 38 percent of operators felt this impacted their ability to manage their businesses, according to FE&S' 2011 Forecast Study. But the tighter credit markets do place increased pressure on members of the supply chain, whose pipeline of booked business for 2011 is somewhat of a mixed bag. Only 34 percent of dealers report they have more business booked for next year compared to the same time frame in 2009, according to FE&S' 2011 Forecast Study. In contrast, 32 percent of dealers say their business booked for next year is comparable to last year's levels at this time, and 34 percent report a decline.

"There are not that many projects coming out because of the capital market structure, and that has a lot more people looking at these jobs," Rimsza says. "The bad news is because we are so pipeline-driven that things will continue to be slower for a while. We have faced tremendous margin erosion, so you have to really set yourself apart from the other guy."

What does it all mean? In those specific instances where it does occur, growth will be modest at best. "The watchword remains cautiously optimistic," Hudson says. "But the sheer duration of the downturn is unprecedented for this industry. We're really at the three-year mark and starting to head into the fourth year. When one looks at the situation now compared to the depths of the recession, it has definitely improved."

What does it all mean? In those specific instances where it does occur, growth will be modest at best. "The watchword remains cautiously optimistic," Hudson says. "But the sheer duration of the downturn is unprecedented for this industry. We're really at the three-year mark and starting to head into the fourth year. When one looks at the situation now compared to the depths of the recession, it has definitely improved."

Despite the skittish consumer psyche, Riehle predicts that 2011 will be a modestly better operating environment than 2010. "The overall trend on a macroeconomic and an industry perspective is positive," he says. "It's just that the growth of that trend is modest and excruciatingly slow."

Technomic seems to agree and projects a growth rate of 2 percent to 2.5 percent for 2011. "We've seen this industry contract for the first time in a long time, but I don't think it will continue," Tristano says. "We've seen recessions, declines at restaurants, but the industry has always bounced back. And it is very likely to start bouncing back next year."

Technomic seems to agree and projects a growth rate of 2 percent to 2.5 percent for 2011. "We've seen this industry contract for the first time in a long time, but I don't think it will continue," Tristano says. "We've seen recessions, declines at restaurants, but the industry has always bounced back. And it is very likely to start bouncing back next year."

Restaurant chains represent one operator group that seems poised for a strong bounce back. "Chains will continue to dominate the marketplace due to economies of scale and overall brand awareness," Tristano says. "I still think that a lot of independents that have closed will reopen as other restaurants. Although we've seen restaurant closures, I don't think we will continue to see declines with respect to the overall number of units."

Riehle shares a similar perspective. "The brand may change, the menu concept may change, but in general it is tough to re-engineer that physical site into another retail function," he says. "So some of the stronger firms are expanding their systems and locking in extremely advantageous real estate and operating cost structures. When things improve they are ready to take more market share."

Still, it is highly likely that the performance of individual foodservice segments will continue to vary widely. "There are going to be pockets of opportunity and success, but some segments, like cafeteria and buffet, will drag everything down. It will be difficult to gauge how the industry as a whole is doing," Tristano says.

Still, it is highly likely that the performance of individual foodservice segments will continue to vary widely. "There are going to be pockets of opportunity and success, but some segments, like cafeteria and buffet, will drag everything down. It will be difficult to gauge how the industry as a whole is doing," Tristano says.

The Foodservice Industry's Response

In response to their customers becoming more fiscally conservative, foodservice operators are taking several steps to maintain market share. For example, many operators are spending more time promoting the value they provide at a price point that resonates with consumers. "Foodservice operators are trying to promote that you can still come in to eat, and it won't cost as much as it once did," Tristano adds. To that point, 60 percent of the operators participating in FE&S' 2011 Forecast Study said they are adjusting their menu strategy to include more value items.

In addition, various foodservice operators are looking to capture market share from other industry segments, Tristano says. For example, many full-service operators are looking down market to grab customers from casual-dining restaurants. And the casual-dining operators are looking to grab a share of the stomach from traditional quick-service restaurant customers.

In addition to retaining customers, foodservice operators must also contend with the rising costs of doing business. For example, wholesale food prices are up 5.4 percent from July 2009 to July 2010, according to Riehle. "Depending upon the menu theme, food costs can be higher for some operators more so than others," he says. In contrast, menu pricing increased only 1 percent to 2 percent during that same time. Despite 36 percent of operators projecting a sales increase, only 20 percent expect higher gross profits, according to FE&S' 2011 Forecast Study.

The practical realities brought on by developments like these have brought other shifts in thinking, resulting in operators spending more time looking for ways to better manage inventory, reduce waste and control rising labor costs. Operators did adjust their purchasing plans in response to the challenging economic environment. For example, 56 percent of operators said they repaired equipment instead of buying new items, while 38 percent said they held off on replacing equipment, according to FE&S' 2011 Forecast Study.

The practical realities brought on by developments like these have brought other shifts in thinking, resulting in operators spending more time looking for ways to better manage inventory, reduce waste and control rising labor costs. Operators did adjust their purchasing plans in response to the challenging economic environment. For example, 56 percent of operators said they repaired equipment instead of buying new items, while 38 percent said they held off on replacing equipment, according to FE&S' 2011 Forecast Study.

Purchases of used equipment are becoming more prominent as a result of the challenging environment. Roughly 10 percent of operators said they bought used items instead of new, according to FE&S' 2011 Forecast Study. In addition, 24 percent of operators said they would likely purchase used items if it would save them money up front.

For their part, 63 percent of foodservice equipment and supplies dealers have noticed a change in the purchasing habits of their operator customers, according to FE&S' 2011 Forecast Study. Along those lines, 69 percent of dealers felt their customers have shown an increased interest in buying used equipment over the past 12 months. Other changes to operating spending habits noted by the dealers include: repairing equipment rather than replacing items (53 percent), smaller order sizes (48 percent), and cancelling projects or putting them on hold (46 percent).

"The one thing this past recession has done is rivet operators' attention on their internal operating cost structure and their need to maintain customer demand," Riehle says. "So as the industry continues to mature, there is a greater focus on longer-term planning. One of the offshoots of longer-term planning is the examination of daily operating expenses."

"The one thing this past recession has done is rivet operators' attention on their internal operating cost structure and their need to maintain customer demand," Riehle says. "So as the industry continues to mature, there is a greater focus on longer-term planning. One of the offshoots of longer-term planning is the examination of daily operating expenses."

One thing that is certain: the foodservice operators are not alone in their introspection. In response to the challenging business environment, 52 percent of dealers report that their purchasing habits have changed in the past year, according to FE&S' 2011 Forecast Study. Changes to dealer purchasing habits during the past 12 months include: consolidating purchases with manufacturers to get better pricing (48 percent), maintaining lower inventory levels (45 percent), making smaller, more frequent purchases from suppliers (43 percent) and, in other instances, making larger but less frequent purchases from suppliers (23 percent).

"You have to look at almost every line item," Rimsza says. "You have to look at your inventory and terms because they are so important. But you have to look at all your costs, including salary and benefits. We have even looked at our telephone costs. It's getting back to basics."

Over time this period of introspection may prove to serve the industry well. "As we emerge from the recession, our businesses will have a much stronger foundation because we were forced to be introspective," Rimsza says.

For example, greater sophistication among operators and their suppliers in their business approaches is casting a more flattering light on such concepts as lowering costs through the use of energy-efficient equipment. "I think that many of the suppliers have become more savvy at communicating the benefits of certain capital expenditures," Riehle adds. "It's easier to document payback in a realistic period of time."

In addition, some multiunit operators are looking to consolidate prep work and other functions in off-premises or centralized locations. This step allows them to achieve certain economies of scale and get a better return on their labor investment. Other restaurant chains have spent time refining the design of their prototype units and even scaling down in size. "It's embracing the reality that a lot of full-servicerestaurants are being used as grab-and-go," Tristano says. "Some concepts are starting to say they don't need the big restaurant. As a result, they are designing their concepts around a lot of changes, but ultimately it comes down to how they control costs as revenues continue to decline."

In addition, some multiunit operators are looking to consolidate prep work and other functions in off-premises or centralized locations. This step allows them to achieve certain economies of scale and get a better return on their labor investment. Other restaurant chains have spent time refining the design of their prototype units and even scaling down in size. "It's embracing the reality that a lot of full-servicerestaurants are being used as grab-and-go," Tristano says. "Some concepts are starting to say they don't need the big restaurant. As a result, they are designing their concepts around a lot of changes, but ultimately it comes down to how they control costs as revenues continue to decline."

Many operators are making subtle changes to their business philosophies, too. "It's not about how many restaurants there are," Tristano says. "It is about how many seats there are in a number of restaurants. Those seats keep your business moving. So a big part of this, moving forward, is how you position your model.

"The goal is always to grow profitably, but today the goal is to break even," Tristano adds. "They are doing what they should have been doing all along: cutting the corporate expense and streamlining the operation. That's not having a huge impact on the customer. But it comes down to managing your costs effectively. The operator mindset is more strategic than before."

Riehle agrees and adds, "The economic downturn has had a substantial re-engineering factor on the industry, both in the front and back of the house. So you see a greater integration of technology so long as the operator is clear on the return on investment."

Indeed, all segments of the foodservice industry have to focus on managing their business as a whole these days, which represents a fundamental shift in their approach. "You used to just be able to focus on the topline. Now we need to focus on the entire business to ensure we have the tightest and best business we possibly can," Rimsza says. "That is harder today because the costs associated with running your business are higher than they were a couple years ago."

Engaging the Customer through Menu Management

More than being smarter about the back-office portion of their business, operators are doing a better job of engaging the customer by broadening their menus in ways that are not as confusing as they were before. "Operators are learning they have to stay within their zone of creativity to make sure your customer accepts what you are doing. If they don't, the customers won't buy from you," Tristano says. "That's the difference between a pizza chain adding desserts instead of sandwiches. One is complementary, and the other moves you into another category."

While many operators look to bolster revenues by expanding into other dayparts, other single-shift restaurants that concentrate their efforts and resources on just two segments — namely breakfast and lunch — are emerging as a force within the industry. "These operators are saying let's focus on what we do best," Tristano says.

While many operators look to bolster revenues by expanding into other dayparts, other single-shift restaurants that concentrate their efforts and resources on just two segments — namely breakfast and lunch — are emerging as a force within the industry. "These operators are saying let's focus on what we do best," Tristano says.

Consumers also place a premium on being able to explore a restaurant's menu through small plates and sampling, Tristano notes. This is a trend operators continue to embrace. "One of the industry's hallmarks is its ability to adapt to customer wants and needs," Riehle adds. "This downturn has spurred innovation both in terms of food and beverage and the way they are running their restaurants."

Another factor operators will need to reckon with in 2011 is the health care legislation initiated by the Obama Administration and ratified by Congress earlier this year. This legislation will place an emphasis on healthier dining options and in some instances require operators to disclose details about the calorie content or sodium levels of specific menu items. "Transparency is going to become a big deal," Tristano says. "There will be some loopholes, like using fewer condiments in preparation to lower calorie counts. Then it will be up to the consumers to add what they want."

In addition, foodservice companies from all segments of the distribution chain will have to address the health care legislation as employers. "The concern is across the board. When you take out the top handful of companies, we are traditionally an industry of small businesses," Rimsza says. "The cost of health care is going to be significant. The administration has built up this mantra of free health care for all, but the reality is someone has to pay for it. The cost of business continues to go up, and it is having an impact on us on a line-item-by-item basis."

Despite these mounting challenges, the very nature of the foodservice industry may be what leads back to a time of higher growth rates. "In general, a restaurant operator is an optimistic entrepreneurial individual that is aware of challenges but is much more upbeat about their capabilities to surmount those obstacles," Riehle points out.

Despite these mounting challenges, the very nature of the foodservice industry may be what leads back to a time of higher growth rates. "In general, a restaurant operator is an optimistic entrepreneurial individual that is aware of challenges but is much more upbeat about their capabilities to surmount those obstacles," Riehle points out.

This entrepreneurial spirit permeates each segment of the foodservice industry, and eventually it will help all members of this diverse business community chase the cloud away.